Service tax implemented on 1 September 2018. Target company was the ability to claim a refund of tax credits when there was sufficient interest cost to offset the taxable dividend income.

Taxation Principles Dividend Interest Rental Royalty And Other So

Dividend Income Update 2021.

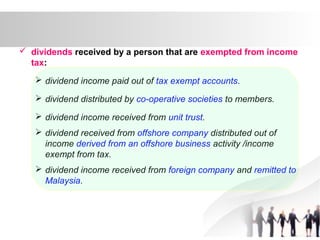

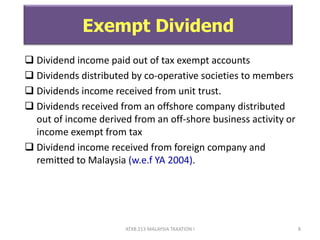

. Dividends are exempt in the hands of shareholders. The following foreign-sourced income received will continue to be exempted from Malaysian income tax from 1 January 2022 to 31 December 2026 5 years Dividend income received by resident companies and limited liability partnerships will be exempted to 2026. Malaysia is under the single-tier tax system.

Malaysia is under the single-tier tax system. Here are 5 tax exempted incomes that can easily apply to you. If you receive a dividend that is calculated as income youll be taxed because of the dividend earned.

Dividends are exempt in the hands of shareholders. All types of income received by individual taxpayers. Hence dividend yields are exempted from tax in the hands of the.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available. Double taxation on foreign dividends is not right. The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and foreign-source dividend income for corporate taxpayers subject to certain conditions.

Once the amendments to the Income Tax Act are passed foreign sourced income that is remitted to Malaysia by Malaysian residents individuals and corporates would be subject to tax starting from 1 January 2022. Services tax is levied at 6 on taxable services supplied by compulsory taxable persons including imported taxable services. Of course there are dividends or benefits that are tax-exempt such as Tabung Haji ASB or Unit Amanah.

Dividends are taxed at a 20 rate for individuals whose income exceeds 209425 those who fall in either the 35 or 37 tax bracket. In Malaysia there is an indirect tax framework that consists of the following core taxes and duties. As a result dividend yields in the hands of shareholders are exempt from tax.

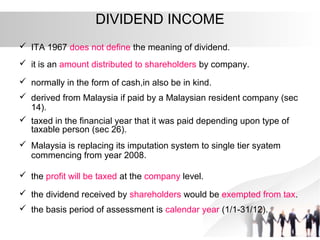

The law currently exempts local dividends from income tax due to the single-tier system that Malaysia adopts. Are Capital Gains or Dividends Taxable in Malaysia. One of the most significant proposed changes to our tax system is imposition of tax on foreign sourced income.

Tax concerns for investments in Malaysia - especially for emerging investment vehicles. Dividend Income Update 2019. Company and LLP who received Dividend Income as FSI in Malaysia will be exempted from tax - for the period from 1 January 2022 to 31 December 2026.

The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates. January 7 2022. Alternatively dividends distributed by a company are taxed at the company level as final tax.

Dividends received by companies and limited liability partnerships. Double taxation is a crime. The tax exemption would allow individual taxpayers to remit their income back to Malaysia tax-free and encourage them to continue to do so.

Instead it is conventional not to put the same income to tax twice. Dividend Income Update 2022. We wish to refer to a report in the Chinese newspaper today which has caused confusion regarding basic questions of income derived from Singapore and tax residence statusGenerally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business.

Malaysian investors should count themselves extremely lucky as capital gains from your stocks are not taxable. The categories of foreign-sourced income that are exempt from income tax are the following. Inland Revenue Board of Malaysia.

If employers provide loans to the employees there will be tax on the interest. Individual who received all types of FSI in Malaysia will be exempted from tax - for the period from 1 January 2022 to 31 December 2026 except for those individuals who carrying out partnership business. The relief is provided in response to the coronavirus COVID-19 pandemic.

Corporate shareholders receiving exempt single-tier dividends can. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. The income tax exemption is effective from January 1 2022 until December 31 2026.

All classes of income received by resident individuals will be exempted by 2026. On March 10 the Inland Revenue Board issued the following clarification. 5 4 The breakdown of taxes on qualified dividends is as.

The Chartered Tax Institute of Malaysia. Even when a person retires and doesnt have income from a job anymore their pension and even gratuity payments are still considered part of their income. Dividend Income Update 2020.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. Income tax exemption on dividends will be granted to companies and Limited Liability Partnerships while individuals will be tax-exempted for all types of income including dividend income. Well not legally a crime.

Capital gain is an increase in your. Malaysia has no capital gains tax regime. While we expect the Inland Revenue.

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. Dividends distributed by a company is taxed at the companys level as a final tax.

Dividend And Growth Investing And What Are Dividends Dividend Magic

Review Of Pitchin Malaysia S Equity Crowd Funding Platform

Taxation Principles Dividend Interest Rental Royalty And Other So

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

Dividend Tax In Malaysia Tax Lawyers In Malaysia

Foreign Sourced Income What Is Remaining Thannees Articles

What S Your State S Dividend Income Tax Thinkadvisor

Taxation Principles Dividend Interest Rental Royalty And Other So

Individual Income Tax In Malaysia For Expatriates

How Is Foreign Sourced Income Taxed Thannees Articles

A Review Of Capbay P2p Lending In Malaysia Dividend Magic P2p Lending Dividend Types Of Loans

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Taxation Principles Dividend Interest Rental Royalty And Other So

How Is Foreign Sourced Income Taxed Thannees Articles

Dividends My Blog Dividends My Blog

Chapter 5 Non Business Income Students

Best Premier Banking In Malaysia Dividend Magic Banking Relationship Management Dividend